Introduction

A stop loss is designed to limit an investor's loss on a security position.

Setting a stop loss order for 10% below the price at which you bought the stock will limit your loss to 10%

Available Markets

•Contracts for difference

•Single Stock Futures

•AlSI/ALMI Futures

1. Classic Stop Loss (Use Triggered Orders). For entering Stop Losses as defined in the Introduction see Triggered Orders

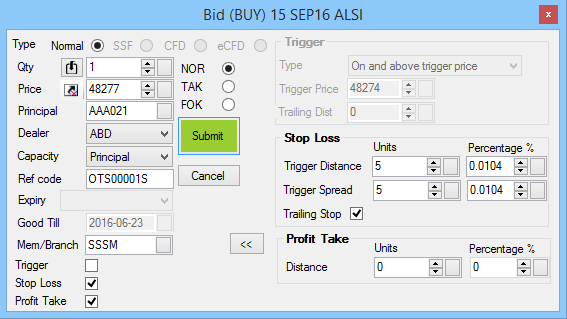

2. Swordfish Stop Loss (Order Window Stop Loss). If you prefer Swordfish to handle the process for you, the order Order Place Box has Stop Loss and Profit Take options:

Note

Profit Take and Stop Loss orders are automatically placed after your order has traded.

The quantities should not be edited. If they are, the system will automatically revert the changes.

Cancelling Profit Take or Stop Loss orders will remove them from the original order. They cannot be replaced.

Stop Loss and Profit Take orders can only be placed from the Order Place Box.

The Swordfish Orders window will simplify the display of TP/SL Orders, their status and linked orders. See Swordfish Order Window

©Estuary Solutions (www.estuarysolutions.com), All rights reserved.