Introduction

An iceberg order is a large single order that has been divided into smaller lots, usually through the use of an automated program, for the purpose of hiding the actual order quantity.

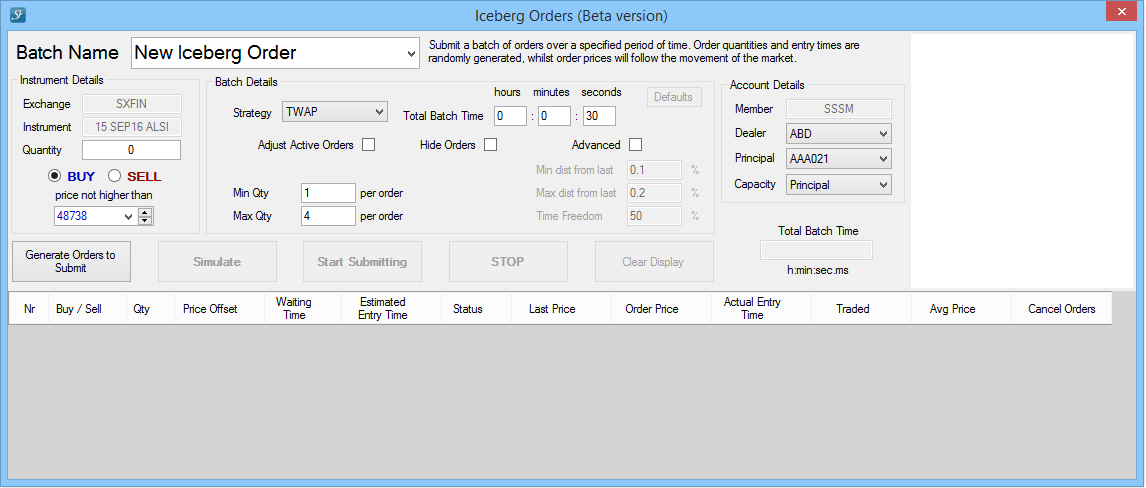

•Window

Advanced Order types permission needs to be activated in order to use Iceberg Orders.

To open the window, right click on the Instrument in the watchlist and then click "Iceberg Order Entry".

•Instrument Details

The exchange and instrument are set when opening the window. Close the window and right click on another instrument to change.

Enter the quantity of the batch order you wish to place and choose buy or sell.

A limit price is set to control the maximum or minimum price of orders

•Batch Details

The minimum and maximum quantities will limit the size of one's order. If the total quantity is not reachable with the given minimum and maximum, the order will not be able to complete calculation.

The "Adjust Active Orders" checkbox will edit all active orders to their relative offsets from the current last price, as the next order is placed.

The "Advanced" checkbox allows one to choose an offset from the current last price as orders are placed. The "Time Freedom" allows for more randomization.

The "POV" Strategy cannot be guaranteed to finish in a given time frame, there for one only chooses what percentage of the live volume you wish to match.

The chart will estimate where orders will be placed on a historic volume model.

•Batch Order Selection

Give a name to each of your batches. Multiple batches may run at the same time.

Batches are not paused or stopped if the window is closed.

•Account Details

Set the account details for orders to go against.

•Action Bar

First the order needs to be generated. One can do this as many times as one likes until the order appears acceptable. One can now simulate it to see what happens. Simulations can be paused or stopped.

When ready, click "start submitting". Submissions can also be paused or stopped. Clear the display to start over.

•Chart Display

A chart is displayed to depict the model volume curve and orders to be placed.

Orders are color coded:

Pending Orange

Active Teal

Canceled Red

Completed Green

•Order Grid

The order grid shows the orders that have been generated. As soon as submission starts, an estimated time will be calculated.

As orders are placed, the actual orders are updated.

You can cancel individual active orders or cancel all active orders by clicking the cancel all header.

Strategies

Although they are often called algorithms, strictly speaking they are more like a family of algorithms or concepts since there is no standard implementation of these algorithms.

1.TWAP (Time Based Splitting)

Order is broken into smaller chunks of equal size and executed at fixed intervals.

Randomization Option: Either size of orders or time intervals can be randomized to a degree.

2.VWAP (Volume Based Splitting)

Attempts to match the VWAP.

Uses a volume profile to predict what the volume will be over the order period and divides the orders accordingly.

E.g. if the order is 100 and total volume over next 50 minutes (order period) is 1000, the algorithm would match 10% every 5 minutes.

3.Volume Profile

Volume is taken over a period.

4.POV (Percentage of Volume)

The algorithm starts by a percentage as input and it keeps calculating the real-time volume for that security. It then matches the given percentage of the volume for each order.

Example: You gave 10% as input and the size of the next order to be placed is 500. The order will be placed when the overall volume for the security reaches 5000 in the interval from the previous order.

Orders may finish early or be left unexecuted.

©Estuary Solutions (www.estuarysolutions.com), All rights reserved.